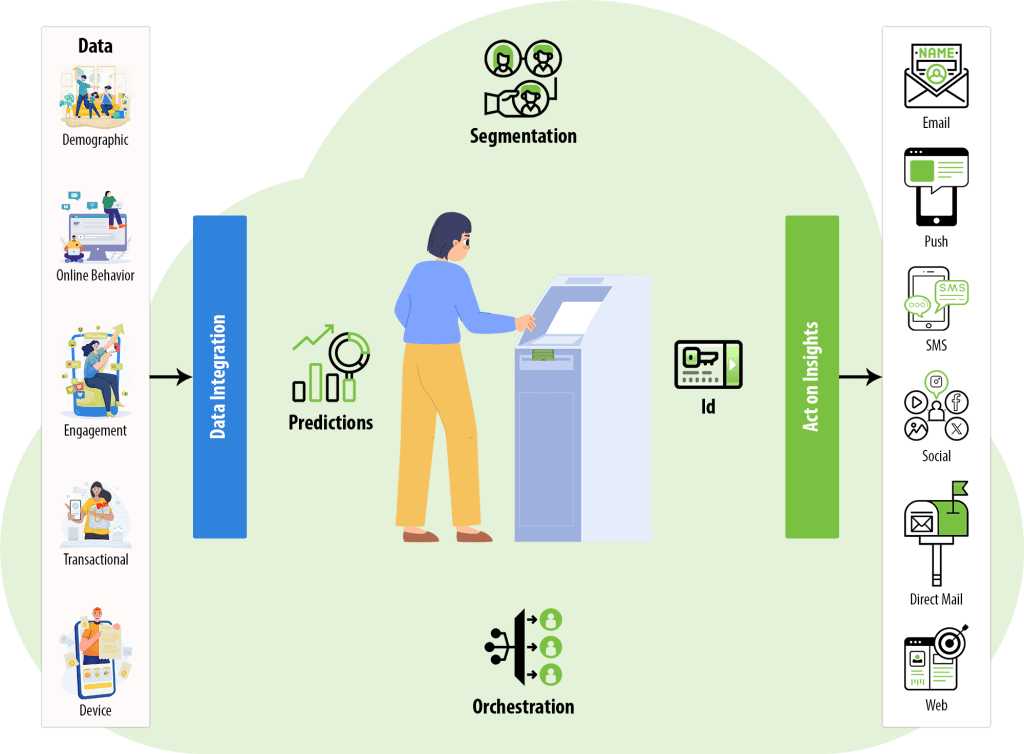

The ongoing evolution in technology has resulted in a surge in the amount of data available to businesses. While this data holds the potential to revolutionize business operations positively, it can also pose significant challenges if not managed effectively. In the financial services sector, businesses are increasingly turning to Customer Data Platforms (CDPs) to help them harness the power of their data. A CDP serves as a unified system for collecting, processing, and analyzing customer data, thereby enabling businesses to deliver personalized experiences that drive customer loyalty and business growth.

Understanding the Role of CDPs in Financial Services

In the digital era, data has become a fundamental asset for businesses. However, this data is often scattered across various databases and systems, making it challenging to gain a unified view of customers. This is where a CDP comes in. A CDP collects customer data from all sources, normalizes it, and builds unique, unified profiles of each customer. This allows businesses to gain a comprehensive understanding of their customers, thereby enabling them to deliver personalized experiences that drive customer loyalty.

In the financial services sector, a CDP can play a pivotal role in managing customer experiences. By centralizing all customer data in a single environment, a CDP can provide financial services teams with omnichannel customer insights, helping them understand customer expectations and deliver better customer experiences.

The Benefits of Integrating a CDP in Financial Services

The integration of a CDP into a financial institution’s infrastructure can significantly enhance data management and the ability to personalize marketing messages. Despite the presence of other data systems, such as Customer Relationship Management (CRM) systems, a CDP offers unique benefits that make it a valuable addition to a financial institution’s data management toolkit.

Improved Data Management

Unlike traditional data management systems, a CDP can capture first, second, and third-party data through a single endpoint, then share it with multiple systems without placing additional tech strain on the app. This ensures that the end-user remains unaffected as additional tools are introduced or updated, or as data schemas are changed.

Enhanced Personalization

A CDP offers a unified view of the customer, allowing marketing and business teams to deliver better customer experiences and drive loyalty. By consolidating all customer data using an AI-based approach, a CDP can help financial institutions create accurate, unified customer profiles.

Streamlined Compliance

A CDP also plays a critical role in data governance, helping enterprises protect sensitive customer data and comply with data security and privacy regulations. With robust security measures in place, a CDP can help financial institutions avoid costly data breaches and protect their reputation.

How CDPs Enhance the Customer Experience

In the financial services industry, the customer experience often spans multiple sales, services, and marketing touchpoints. By providing a unified view of the customer, a CDP enables financial institutions to deliver consistent, personalized experiences across all these touchpoints.

Customer Data Unification

Self-Service Access

Journey Orchestration

Data Governance

For instance, a CDP can help financial institutions stay up-to-date with their customers’ devices. When new devices or operating system updates roll out, financial institutions need to ensure their apps function perfectly on these devices. A CDP can help manage this process, reducing the need for updates to individual services’ SDKs and ensuring all tools perform correctly.

Furthermore, the use of a CDP can enable financial institutions to deliver more relevant content in their marketing campaigns. By understanding who their audience is and what they need, financial institutions can tailor their messages to be more relevant, thereby improving the effectiveness of their marketing efforts.

The Importance of Data Governance in CDPs

With increasing amounts of customer data being collected, financial institutions face the growing responsibility of protecting sensitive customer information and complying with data security and privacy regulations. A breach can have costly repercussions and can erode hard-earned customer trust. As such, strong data governance protocols are essential.

CDPs play a critical role in data governance. They not only help enterprises protect sensitive customer data but also do so while helping brands grow and scale their use of customer data. For instance, TransactionTree, offers consultations and workshops during every implementation led by data security professionals with extensive experience in financial services. Their platform also includes robust security measures such as compliance and certifications, encryption everywhere, and enterprise admin tooling.

Personalizing Customer Experiences with CDPs

Personalization is a key strategy for delivering superior customer experiences. However, personalization requires a deep understanding of the customer, which can be challenging to achieve given the fragmented nature of customer data.

A CDP can help financial institutions overcome this challenge by unifying customer data and enabling the creation of comprehensive customer profiles. With these profiles, financial institutions can deliver personalized experiences that meet customer expectations and drive loyalty.

For instance, a CDP can help financial institutions provide educational resources and guidance to customers based on their unique life stages. It can also help design customer journeys based on churn risk and improve retention with proactive outreach.

The Role of CDPs in Journey Orchestration

Customer journey orchestration involves managing the customer experience across various touchpoints. A CDP can play a critical role in this process by providing a unified view of the customer and enabling the delivery of consistent, personalized experiences across channels.

For instance, TransactionTree provides native orchestration capabilities focused on delivering a data-driven experience to customers across channels. This can include email, SMS, direct mail, and more. By choosing the right CDP to orchestrate personalized journeys across channels, financial institutions can deploy use cases that reduce churn, lower costs, and increase customer satisfaction scores.

The Significance of Identity Resolution in CDPs

Identity resolution is a critical component of customer experience management. It involves reconciling customer data into unique profiles across multiple channels and devices. This helps businesses build a single customer view, which underlies consistent, trust-building customer experiences.

Many CDPs offer features that assist with identity resolution. For instance, TransactionTree uses both deterministic and probabilistic matching to build complete customer profiles across channels and touchpoints. This capability can be a game-changer for financial institutions, enabling them to deliver more personalized and connected customer experiences.

CDPs as a Self-Service Solution: Empowering Business Teams

One of the main advantages of CDPs is their self-service nature. They provide a toolset for analytics and orchestration that’s designed with business users in mind, making data, analytics, and orchestration workflows accessible to the teams responsible for customer experience.

By deploying a CDP, financial institutions can reduce the obstacles between marketing, services, and sales teams and the data that will make a difference in the quality of customer experiences. This can ultimately help financial institutions take a step towards becoming a customer-first organization.

The Future of CDPs in Financial Services

The CDP market is forecast to grow at a significant rate in the coming years. As financial institutions continue to modernize their core systems, they have an opportunity to integrate a CDP that will make it easier to tap into the potential of customer personalization.

The future of CDPs in financial services looks promising. By centralizing customer data and enabling the delivery of personalized experiences, CDPs can help financial institutions gain a competitive edge, drive customer loyalty, and achieve business growth.

Conclusion

In the digital era, data has become a key asset for financial institutions. However, managing this data effectively can be a challenge. Customer Data Platforms (CDPs) offer a solution to this challenge, providing a unified system for collecting, processing, and analyzing customer data. By integrating a CDP into their operations, financial institutions can gain a comprehensive understanding of their customers, deliver personalized experiences, and drive business growth.

CDPs are set to play an increasingly important role in the financial services sector. As these platforms continue to evolve and become more capable, they can help financial institutions stay ahead of the curve, adapt to changing customer expectations, and excel in an increasingly competitive market.